Prop A Frequently Asked Questions

On this page

General FAQs

Expand AllWhat is a Prop A?

Proposition A, or a Voter-approved Tax Ratification Election, is a special election called by a school district’s Board of Trustees, asking voters to approve an increase above the current operating tax rate. Watch the video to learn more.

Why did the district call an election?

Garland ISD convened a Steering Committee in May of 2025. The purpose was to study the district’s financial needs, assess the district’s key priorities, and make a recommendation on a possible proposition to support the Maintenance & Operation (M&O) budget.

More than 50 community members met three times over two months. Committee members included parents, community leaders, staff, and students.

After reviewing the data, the committee made a recommendation to the GISD Board of Trustees to call for a $0.12 Voter Approval Tax Rate Election at their June 24 meeting.

What is the M&O budget?

School districts operate with two budgets. The Maintenance and Operations (M&O) pays for day-to-day instructional and operating costs like salaries, benefits, supplies, maintenance, food and fuel. The Interest & Sinking (I&S) pays for capital improvements like new construction, renovations, large repairs, and other projects in bond elections.

What has contributed to the Garland ISD budget deficit?

The following factors have contributed to the GISD budget deficit:

- Unfunded Mandates: State and federal laws require costly programs like armed security or certain instructional supports without providing additional funding.

- Declining Enrollment & Lower ADA: We now serve fewer students, and our ADA (Average Daily Attendance) has dropped faster than enrollment, which directly reduces funding.

- Inflation: Inflation has driven up costs, but the state increase in per-pupil funding was less than 1%.

- Expenditures per student have increased 20% since 2019 ($8,665 in 2019-20 to $11,369 in 2024-25)

- TRE Failure + M&O Budget Pressure: The failed Tax Ratification Election (TRE) in 2020 left us with no option to raise local dollars to provide competitive salaries, without cutting elsewhere.

- Extreme Weather: Frequent wind, rain, and snowstorms have caused unexpected facility damage and are increasing our operating costs (HVAC, repairs, emergency response)

GISD has implemented cost-containment measures over the last several years, including the consolidation of schools and the streamlining and reassignment of staff, starting with central office positions. The district has protected key investments without undergoing a reduction in force.

Garland ISD has been fiscally responsible and strategic; however, the funding gap is bigger than cost-saving strategies alone can solve.

Doesn’t the new legislation (House Bill 2) provide more funding to the District?

Yes, HB2 provides an additional $55 to the Basic Allotment (BA) through a reduction in funding in other areas. To keep up with inflation, Texas districts need a $1,400 increase per student. The majority of HB2 goes to teacher/support staff salaries, 54.37%. In Garland ISD, only $2 million, which is 7.64% of the funding received, is not tied to a spending requirement. The additional $27 million from the state does not cover the district’s $60 million budget shortfall.

HB2 does not address Garland ISD’s funding deficit or sustain operations at current levels of programming.

How much is the proposed tax rate increase?

The Garland ISD Voter Approval Tax Rate Election is $0.12. If Prop A is approved, the average monthly impact on a $400,000 home would be an additional $3.77 per month.

My home value has risen so I am paying more school taxes. Doesn’t this mean GISD has more operating funds?

Unfortunately, no. Increases in GISD home values do cause a homeowner’s school taxes to rise, but the increases do not provide an ongoing benefit to the district’s operating budget. It actually has the opposite effect. As GISD collects more money from local taxpayers due to increased property values, state operating funding for GISD decreases.

In fact, state officials have often used the benefit of additional local tax dollars generated in school districts like GISD to fund other parts of the state budget unrelated to public education.

Financial impact FAQs

Expand AllHow will the TRE impact a homeowner’s school taxes?

If Prop A is approved, the average monthly impact on a $400,000 home would be an additional $3.77 per month.

Impact includes the most recent compression and assumes the additional $40,000 homestead exemption is approved by voters in November. The combination of compression and an additional $40,000 on top of the existing $100,000 homestead exemption will cut school property taxes for a homesteaded property. This is would take effect in January 2026.

How am I financially impacted if I’m over 65 years old?

Property taxes for citizens 65 years or older—or those who are disabled—are not affected by a rate increase, if the appropriate homestead exemptions are filed with the County Appraisal District.

How did the most recent Legislative Session impact property tax for those 65 years old?

In 2025, the Texas Legislature passed significant property tax relief measures aimed at homeowners aged 65 and older. This means eligible individuals can now receive a total school tax exemption of up to $200,000 - combining the $140,000 general exemption and the $60,000 over 65/disabled exemption - if it is approved by voters in November.

The existing school district tax ceiling for seniors remains, ensuring that school district taxes on your home won't increase after you qualify, unless you make major home improvements.

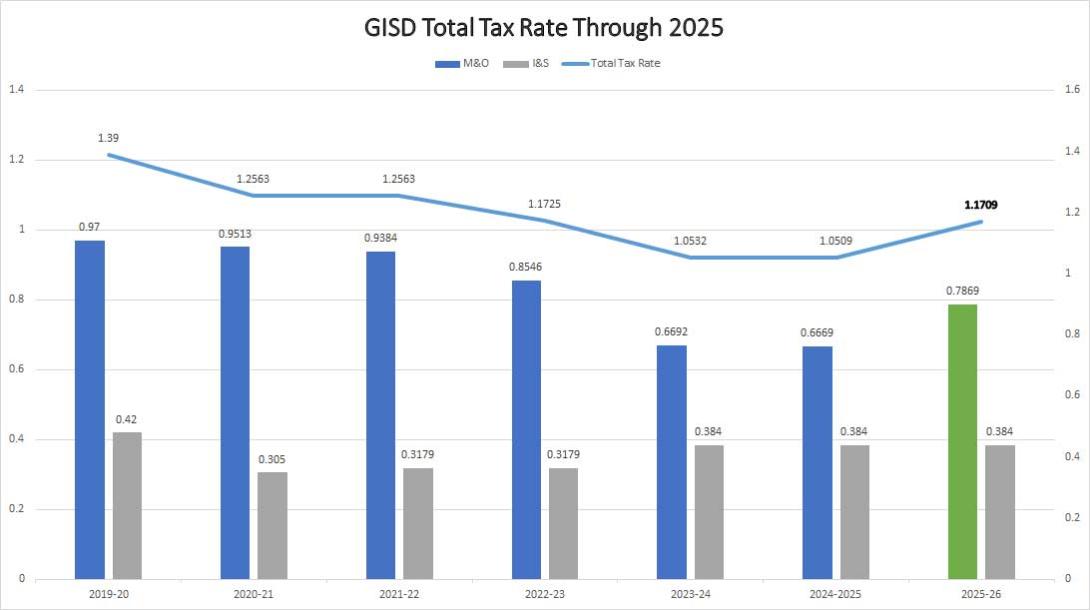

What has GISD’s Maintenance & Operations (M&O) tax rate been?

See the M&O tax rate history in the table and graph below.

| Year | M&O | I&S | Total Tax Rate |

|---|---|---|---|

| 2019-20 | 0.9700 | 0.4200 | 1.3900 |

| 2020-21 | 0.9513 | 0.3050 | 1.2563 |

| 2021-22 | 0.9384 | 0.3179 | 1.2563 |

| 2022-23 | 0.8546 | 0.3179 | 1.1725 |

| 2023-24 | 0.6692 | 0.3840 | 1.0532 |

| 2024-2025 | 0.6669 | 0.3840 | 1.0509 |

| 2025-26 | 0.7869 | 0.3840 | 1.1709 |

What is the M&O tax rate of other districts in the area?

| District | M&O Tax Rate |

|---|---|

| Plano ISD | 0.8405 |

| Arlington ISD | 0.8249 |

| Richardson ISD | 0.7931 |

| Forney ISD | 0.7892 |

| Dallas ISD | 0.7718 |

| Frisco ISD | 0.7575 |

| Grand Prairie ISD | 0.7575 |

| Wylie ISD | 0.7575 |

| Mesquite ISD | 0.6992 |

| Garland ISD* | 0.6692 |

| Rockwall ISD* | 0.6692 |

*Districts that have not passed a Prop A voter-approved tax rate election that funds maintenance & operations (M&O).

What comprises the GISD Maintenance and Operations (M&O) budget?

A school district M&O budget (commonly called the operating budget) is comprised mostly of personnel. In Garland ISD, 83% of the M&O budget is employee salaries.