Bond 2023 Tax Impact

A bond is similar to a home mortgage. It’s a contract to repay borrowed money with interest over time. Bonds are sold by a school district to competing lenders to raise funds to pay for the costs of construction, renovations and equipment. Principal and interest on the bonds are repaid over an extended period of time with funds from the Debt Service (Interest & Sinking or I&S) tax rate.

If all three propositions are approved by voters, the Garland ISD property tax rate will increase by approximately $0.0661 over the current tax rate.

Residents of the district who are 65 years or older, or who are 100% disabled veterans, will not be affected by this tax rate increase, as their tax rates can be capped once they apply and are granted an exemption by the appropriate county appraisal district.

Continue reading to learn more about school taxes and the impact of the bond.

On this page

How much would the I&S tax rate increase?

|

Proposition |

Total Amount | Increase Above Current I&S Tax Rate of $0.3179 |

|---|---|---|

| Prop A | $1,103,130,000 | $0.0570 |

| Prop B | $135,910,000 | $0.0070 |

| Prop C | $40,605,000 | $0.0021 |

| Total | $1,279,645,000 | $0.0661 |

$0.3179 (current rate) + $0.0661 (increase) = $0.3840 Estimated Max I&S Tax Rate (Including Net Existing Debt)

How would the bond impact my taxes?

| Proposition | Prop Amount | Increase Above Current I&S Tax Rate of $0.3179 | Annual Tax Increase | Monthly Tax Increase |

|---|---|---|---|---|

| Prop A | $1,103,130,000 | $0.0570 | $148.20 | $12.35 |

| Prop B | $135,910,000 | $0.0070 | $18.20 | $1.52 |

| Prop C | $40,605,000 | $0.0021 | $5.46 | $0.46 |

| Total | $1,279,645,000 | $0.0661 | $171.86 | $14.32 |

*The average market value of homes in GISD is $300,000. All Texas homeowners are eligible to receive a $40,000 state homestead exemption on school taxes.

Example: $300,000 home less $40,000 mandatory homestead exemption equals $260,000 in taxable value after exemption.

Taxable home value after $40,000 mandatory homestead exemption

Tax Impact Estimator

Exemptions for Over 65 and 100% Disabled Veterans

If you are a homeowner who has applied for and been granted an Over 65 or 100% Disabled Veteran Homestead Exemption with the appropriate county, the school tax portion of your property tax won’t increase (unless you have made major improvements to your property.) This is true regardless of the election results or the adopted school tax rate.

See the Residence Homestead Exemption form for Dallas County. Note you will start by searching for your property.

Understanding the Tax Rate

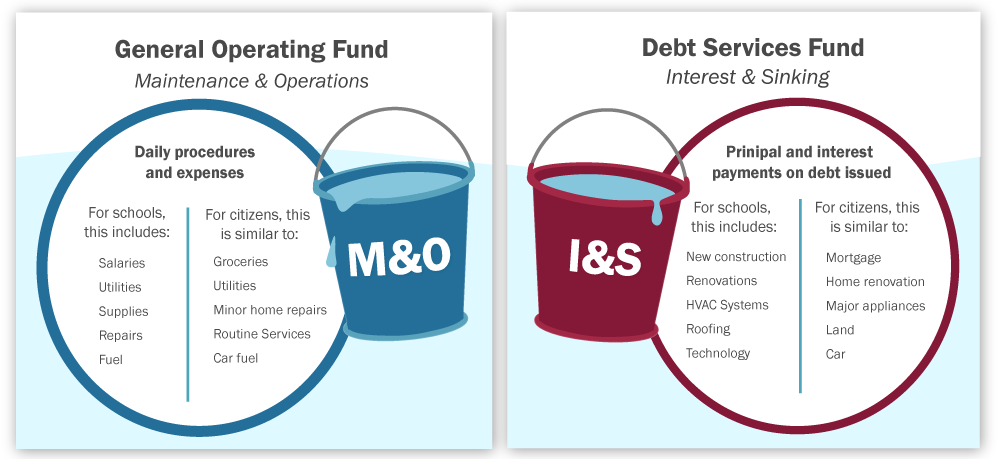

In Texas, school district budgets are funded by two different tax rates and each rate can only be used for certain types of expenses.

- Maintenance & Operations (M&O) funds are used for day-to-day operations to pay for salaries, supplies, utilities, insurance, fuel, etc.

- Interest & Sinking (I&S) funds can only be used to pay back debt incurred for items such as construction, renovations, buses, land, technology, and the cost of issuing bonds.

How does GISD’s tax rate compare to other districts?

The district's already low tax rate would remain lower than many neighboring districts if the bond were to pass.

Local School District Tax Rates

| Entity | M&O Rate | I&S Rate | Total Rate | County |

|---|---|---|---|---|

| Wylie ISD | $0.9429 | $0.4550 | $1.3979 | Collin |

| Mansfield ISD | $0.9746 | $0.3600 | $1.3346 | Tarrant |

| Allen ISD | $0.9404 | $0.3900 | $1.3304 | Collin |

| Richardson ISD | $0.9646 | $0.3500 | $1.3146 | Dallas |

| McKinney ISD | $0.9429 | $0.3700 | $1.3129 | Collin |

| Arlington ISD | $1.008 | $0.3007 | $1.3087 | Tarrant |

| Grand Prairie ISD | $0.9429 | $0.3641 | $1.307 | Dallas |

| Mesquite ISD | $0.8846 | $0.4000 | $1.2846 | Dallas |

| Fort Worth ISD | $0.9896 | $0.2920 | $1.2816 | Tarrant |

| Plano ISD | $1.0224 | $0.2374 | $1.2598 | Collin |

| Garland ISD Expected maximum tax rate with passage of bond election |

$0.8546 | $0.3840 | $1.2386 | Dallas |

| Lewisville ISD | $0.8559 | $0.3809 | $1.2368 | Denton |

| Rockwall ISD | $0.8546 | $0.3600 | $1.2146 | Rockwall |

| Frisco ISD | $0.9429 | $0.2700 | $1.2129 | Collin |

| Dallas ISD | $0.9429 | $0.2420 | $1.1849 | Dallas |

| Garland ISD (current) | $0.8546 | $0.3179 | $1.1725 | Dallas |

| Irving ISD | $0.9056 | $0.2418 | $1.1474 | Dallas |

| Carrollton-Farmers Branch ISD | $0.9429 | $0.2000 | $1.1429 | Dallas |

| Highland Park ISD | $0.9078 | $0.1700 | $1.0778 | Dallas |

Source: comptroller.texas.gov/taxes/property-tax/rates

Download the PDF version

Dallas County School District Tax Rates

| Entity | M&O Rate | I&S Rate | Total Rate | County |

|---|---|---|---|---|

| Lancaster ISD | $0.9406 | $0.4375 | $1.3781 | Dallas |

| Sunnyvale ISD | $0.9605 | $0.4141 | $1.3746 | Dallas |

| Richardson ISD | $0.9646 | $0.3500 | $1.3146 | Dallas |

| Cedar Hill ISD | $0.9746 | $0.3360 | $1.3106 | Dallas |

| Grand Prairie ISD | $0.9429 | $0.3641 | $1.3070 | Dallas |

| Mesquite ISD | $0.8846 | $0.4000 | $1.2846 | Dallas |

| DeSoto ISD | $0.9429 | $0.3153 | $1.2582 | Dallas |

| Duncanville ISD | $0.9329 | $0.3200 | $1.2529 | Dallas |

| Ferris ISD | $0.9385 | $0.3000 | $1.2385 | Dallas |

| Coppell ISD | $0.9867 | $0.2306 | $1.2173 | Dallas |

| Dallas ISD | $0.9429 | $0.2420 | $1.1849 | Dallas |

| Garland ISD (current) | $0.8546 | $0.3179 | $1.1725 | Dallas |

| Irving ISD | $0.9056 | $0.2418 | $1.1474 | Dallas |

| Carrollton-Farmers Branch ISD | $0.9429 | $0.2000 | $1.1429 | Dallas |

| Grapevine - Colleyville ISD | $0.9091 | $0.2217 | $1.1308 | Dallas |

| Highland Park ISD | $0.9078 | $0.1700 | $1.0778 | Dallas |

Source: dallascounty.org

Download the PDF version

Seven County Tax Rate Comparison

GISD has the 64th lowest tax rate out of the 74 districts in Dallas, Denton, Collin, Tarrant, Ellis, Rockwall and Kaufman counties.

Download the chart to see the full list of tax rates within the seven counties.

GISD Tax Rate History

Hover over the chart to see specific rate details.

Financial transparency

Garland ISD’s commitment to transparency and fiscal responsibility has earned the district the highest rating possible by the state’s Financial Integrity Rating System, as well as earning Transparency Stars from the Texas Comptroller and the Award of Merit and the Award of Excellence by the Texas Association of School Business. The district also holds top ratings for creditworthiness: Aaa from Moody’s, AA from Standard & Poor's and AA+ Bond Rating from Fitch. These are all indicators of the district’s strong capacity to meet financial commitments.

We pledge to continue this tradition of responsible management of tax dollars. Should voters approve this year’s bond referendum it will be reported on monthly in the Finance, Facilities and Operations Board Committee Meeting.

See the Financial Information page to learn more about district finances.

Need more information?